The German Social State on Trial

German Health Insurer Lawsuit at the Social Court of Berlin

Introduction to the Statement of Claim

The following article demonstrates, step by step, how IKK Classic not only enabled but actively created and maintained the artificial mass deficiency. All quotations come from letters issued by the insolvency administrator and the tax office—documents that IKK Classic also received. This proves that the defendant acted with full knowledge of the situation.

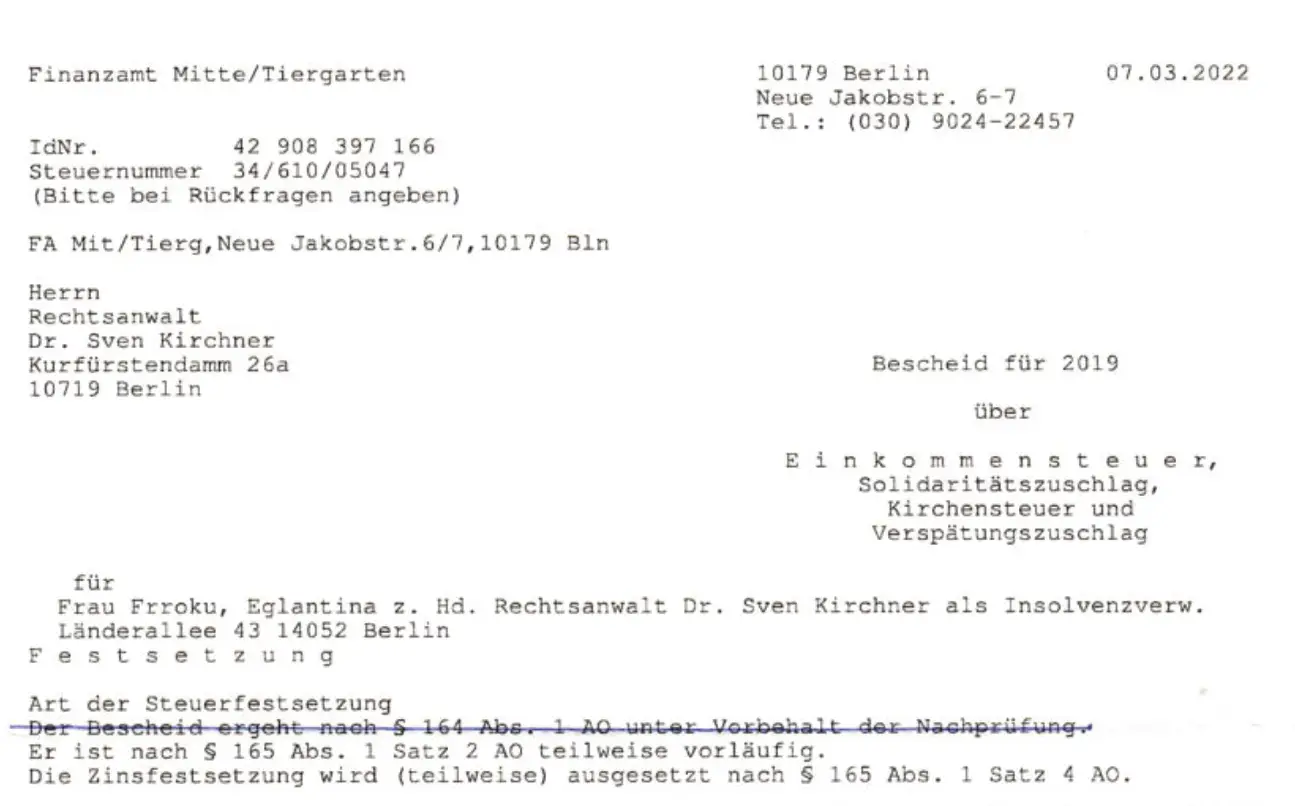

The Tax Assessments of 7 March 2022—Proof That No Tax Return Was Filed

The tax assessments for 2019 and 2020 were issued on 7 March 2022 by the Berlin Mitte/Tiergarten tax office. They were addressed directly to:

“Recipient: Attorney Dr. Sven Kirchner, Kurfürstendamm 22a, 10719 Berlin.”

“for Ms. Frroku, Eglantina, c/o Attorney Dr. Sven Kirchner as insolvency administrator”

Under the settlement date of 28 February 2022, the tax office added:

“Please pay EUR 75.00 by 11 April 2022 to one of the listed accounts.”

The assessments were marked “partially provisional”, because the tax base had to be estimated. The tax office explicitly warned:

“Please submit the tax return, as the estimate does not release you from your filing obligation.”

These details show that the assessments were sent directly to the insolvency administrator, not to the plaintiff, and that they should have been in the court file. They also prove that the insolvency administrator had not filed the tax returns by the deadline, even though the insolvency proceedings continued until 14 September 2022.

As a result, the economic situation of the company was determined not by real data but by an estimate.

IKK Classic Requested the Assessments Only After Mass Deficiency Was Declared

Although the assessments had been with the insolvency administrator since 7 March 2022, IKK Classic began requesting them from the plaintiff only from 18 October 2022 onward—eight times. These requests came after the insolvency administrator had already declared the estate mass deficient.

By doing so, IKK Classic concealed two critical facts:

The insolvency administrator had not filed any tax return for ten months, and the tax assessments already existed and were in his possession.

As long as IKK Classic kept requesting the assessments from the plaintiff, it avoided demanding the tax return from the insolvency administrator—the only person legally responsible.

Why the Tax Return Is Crucial: Without It, Mass Cannot Be Formed

A tax return is the only document that activates investments, records revenues, documents assets, shows the use of loans, and reflects the real economic situation. Without it, all economic activity remains invisible.

The insolvency estate stays artificially low. Assets are not activated. The balance sheet shows only three euros in assets.

No tax return → no mass formation → mass deficiency.

The Insolvency Administrator Had All Documents—Yet IKK Classic Never Demanded the Tax Return

The insolvency administrator confirmed that he had reviewed business records, files, and all relevant documents. He had everything needed to prepare the tax return—he simply did not do it.

IKK Classic, as a creditor, should have recognized that the tax return was missing and should have demanded it, especially because its own claim depended on the correct determination of the estate. Instead, it repeatedly requested the assessments from the plaintiff and ignored the missing tax return.

This omission allowed the artificially low estate to remain uncorrected.

A Manipulated Basis: The Mass Deficiency Was Created—Not Found

Until July 2022, the plaintiff repeatedly argued that no mass deficiency existed. Only then did the insolvency administrator present a cost calculation containing unusual surcharges:

“25% surcharge for disordered bookkeeping”

“50% surcharge for obstructive and uncooperative behavior”

“50% surcharge for examination of restructuring and continuation possibilities”

These surcharges produced costs of EUR 5,710.26, while the available assets amounted to only EUR 140.35.

The insolvency administrator then declared:

“The proceedings are mass deficient and must be discontinued.”

“The existing estate will be used entirely to pay court costs.”

IKK Classic received these letters as well.

The Vicious Circle: How IKK Classic Actively Created and Maintained the Mass Deficiency

When the plaintiff demanded the tax return in November 2022, the insolvency administrator replied:

“I will not prepare a tax return, as the proceedings are massively deficient and the costs cannot be covered.”

“After the discontinuation of the mass deficiency proceedings, you may file the return yourself.”

This letter was also sent to IKK Classic.

Thus, the defendant knew that no tax return existed, that the mass deficiency was being used as an excuse, that the economic situation had never been properly determined, that assets had not been activated, and that the mass deficiency was artificially created.

IKK Classic requested the assessments from the plaintiff only after the mass deficiency had been declared. This allowed it to conceal for months that the insolvency administrator had not filed the tax return, that the assessments already existed, and that the mass deficiency was the result of this omission.

This stabilized the vicious circle:

No tax return meant no activation of assets, which produced mass deficiency, and mass deficiency was then used to justify not filing the tax return, keeping assets at zero.

IKK Classic Is the Central Cause of the Artificial Mass Deficiency

The defendant requested the assessments from the wrong person, concealed the missing tax return, prevented the activation of assets, stabilized the artificially created mass deficiency, and contributed directly to the economic destruction of the plaintiff.

Without the actions of IKK Classic, the mass deficiency would not have arisen.

Further reading

Introduction to the Statement of Claim (Case S 71 KR 2202⁄24)

Original documents

Statement of Claim (German original)

Related analysis:

Germany’s welfare state doesn’t need reform—it needs detoxification