Where Law Ends and Ideology Begins:

The Uwe Seltmann System

The Injustice Chronicle — Emergency Edition No. 1

A documented investigation into structural illegality and state‑enabled identiy manipulation.

Executive Summary

A documented case of structural illegality, state‑enabled identity manipulation, and the emergence of right‑wing ideology within German institutions.

This dossier exposes a recurring pattern within German state institutions in which legal obligations are systematically ignored, contradictory identity data is accepted without scrutiny, and state action aligns not with statutory law but with the interests of a single individual: Uwe Seltmann.

Across criminal investigations, civil proceedings, financial supervision, and insolvency law, the same structure reproduces itself: the protection of a dual identity, the concealment of financial origins, and the exclusion of a foreign‑born entrepreneur who demanded accountability.

The evidence presented here demonstrates that these are not isolated errors, but manifestations of a deeper ideological shift within state structures — a shift in which law is subordinated to political and ideological motives.

Introduction

The Foundational Breach

When state authorities cease to act in accordance with the law, it is not merely an individual case that is affected, but the very foundation of the rule of law itself. This becomes evident whenever a dispute arises between two parties: in such situations, the justice system is obligated to investigate fairly, objectively, and in strict adherence to statutory requirements. Yet when, across multiple proceedings and through various institutions, legal standards are systematically disregarded, the process can no longer be described as lawful. It becomes ideological. It becomes political. It becomes structural.

The Recurring Pattern

This dossier documents a recurring pattern that reproduces itself across criminal law, civil law, financial supervision, and insolvency proceedings — always with the same outcome: the protection of Uwe Seltmann’s dual identity, the concealment of his financial sources, and the preservation of the network that disseminated DOPiX worldwide, kept German corporations financially afloat, and simultaneously eliminated the author of this dossier from the economic landscape due to her Albanian origin and her former fashion business — because she did not fit the city’s image and because she demanded accountability.

The Break with Logic

As the legal philosopher Ulrich Klug observed in 1960, legal science can only exist where state action follows the norms of logic. “Without submission to the rules of logic, no meaningful discussion is possible.” When authorities fail to examine contradictions, ignore statutory duties, or refuse to evaluate evidence, they depart from the realm of law and enter the realm of ideology. The Seltmann Operation demonstrates precisely this departure: state action was not guided by law, but by the protection of one individual.

The Conflicting Identities

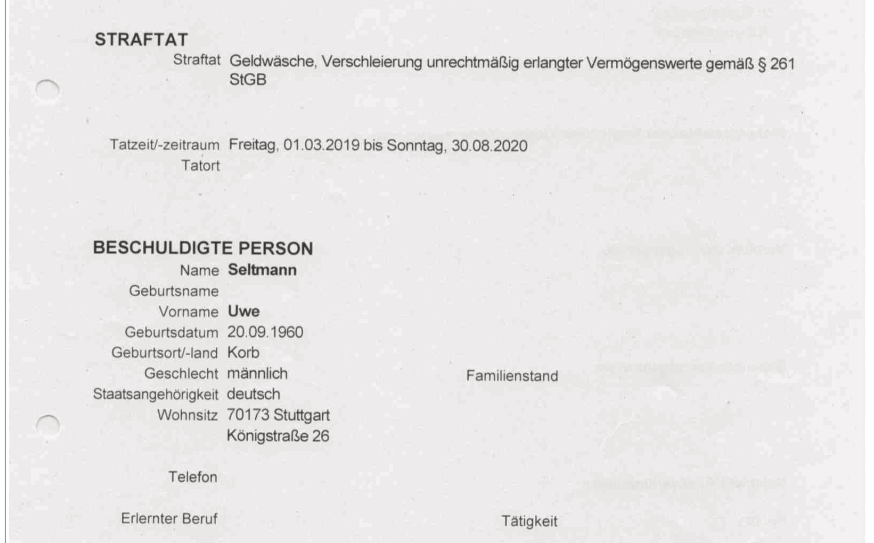

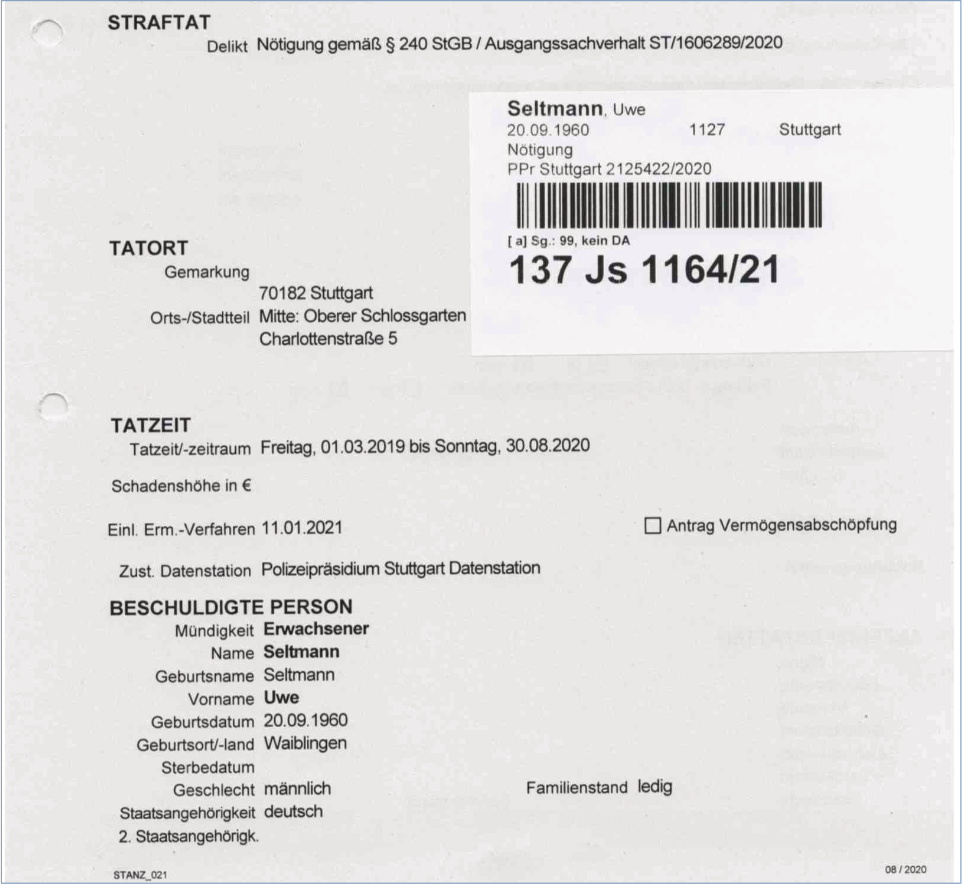

The case files 212 Js 115523⁄20 and 137 Js 1164⁄21 contain two conflicting sets of identity data arising from identity checks under §163 StPO and §152(2) StPO. A single person cannot simultaneously possess two birthplaces, two identities, and two legal roles. Yet the authorities accepted these contradictions without clarification.

The Financial Contradictions

Uwe Seltmann — developer and central figure in the global expansion of DOPiX through IBM partnerships and the sale of the software to NEOPOST S.A. in France — is reported as the founder and owner of icon Systemhaus. The acquisition of icon Systemhaus was in fact carried out by Neopost France, as publicly reported. Whether the contract submitted by Seltmann to investigators refers to this acquisition remains unclear, as the document lacks both notarized certification and signatures. Without the decisive page that validates the contract and proves the origin of the funds — a page the police neither replaced nor requested — the source of the money remains unproven.

The Forty‑Two Accounts

The “sale” of DOPiX alone generated millions of euros, all deposited into a single account held exclusively in Uwe Seltmann’s name. According to the BaFin report of 8 January 2021, there are forty‑two bank accounts associated with his name. Yet inquiries were made into only two accounts: the private account was, as the police reported verbatim on 7 January 2021, “not evaluated,” and the business account inquiry was withdrawn because it was deemed “unnecessary,” as stated by the Stuttgart Police Headquarters.

The Constructed Insolvency

Despite clear indicators of document forgery arising from the dual identity — including a ten‑digit ID number despite the statutory nine‑digit standard, an inconsistent place of issuance, and a birthplace that does not match the actual one — the police made no record of these discrepancies. The investigation was terminated, and Uwe Seltmann was never entered into the web.sta database as a suspect. This allowed him and his associates to pursue the exclusion of the fashion entrepreneur through a debt‑collection procedure in which the judiciary manually assigned an attorney as the authorized recipient of the court notice, after the electronic system flagged an error because the attorney did not match the legal form of the respondent.

The private and commercial loans used against the entrepreneur did not serve to finance a business but to construct its insolvency. The immediate repayment of the loan, the mixing of private and business funds, and the absence of economic rationale correspond to classic indicators of money laundering. Capital was not deployed as investment, but as a tool of control and exclusion. The insolvency administrator and creditors — IKK classic and the Berlin‑Mitte/Tiergarten tax office — created an insolvency proceeding built on artificial asset poverty by ensuring that no tax returns were filed. No tax return means no recognized assets, no insolvency estate, and thus “asset poverty.” This artificial poverty is further evidenced by the fact that no claims — including one raised by an attorney whose complaint was forwarded by the Stuttgart Bar Association to the General Prosecutor’s Office — were acknowledged. The investigation lasted two years, mirroring the duration of the insolvency proceedings. Immediately after the case was closed, the attorney admitted that he had “forgotten” to invoice his services, despite the insolvency administrator repeatedly claiming to have spoken with him and that all invoices had been settled. The attorney still did not pay after the insolvency case was closed, despite continuous demands, while prosecutors argued there had been no intent — only “forgetfulness.”

The Structural Dimension

The Seltmann Operation is not an isolated incident, nor is it a chain of errors — and the chain does not end here.

The Political Implications

It is a documented example of how state procedures — independent of one another — reproduce the same structure, acting not according to the law, but according to the law of Uwe Seltmann. There can be no talk of rule of law where state action is not guided by statute and constitution. Judicial decisions and prosecutorial assessments construct the narrative that the insolvency resulted from incompetence rather than exclusion. And when the author sought to expose the truth of the money in her 2022 book The Truth of Money, physicians withdrew the Thyroxin medication that had replaced her removed thyroid for ten years. Had her father not died in December 2023, organ failure and a myxedema coma would have followed — and the matter would have remained buried forever.

Conclusion

This is not opinion. It is documented right‑wing ideology embedded within state structures. The documents prove it. They appear both within the text and in full at the end of this dossier. Behind the scenes, structures have been created that shift Germany to the right and prepare the ground for this development.

Germany’s right‑wing ideology is not emerging. It is already in power — not only through the rise of the far‑right party Alternative for Germany (AfD), but through governments and coalitions across all parties.

Key Findings

• Dual identities accepted as lawful

German authorities documented two contradictory identities for the same individual — including different birthplaces, ID numbers, and legal roles — and processed both without clarification.

• Financial origins remained unexamined and concealed through halted investigations

Authorities issued no comprehensive requests for bank information, examined only a single account without evaluating it, and left both the origin and the volume of the funds unexplained. With the termination of the investigations, all financial inconsistencies — including the unverified source of the money — remained undisclosed.

• Indicators of document forgery ignored

A ten‑digit ID number (despite the statutory nine‑digit standard), inconsistent issuance data, and a birthplace that does not match the actual one were never recorded or investigated.

• State action aligned with one individual, not the law

Across criminal, civil, financial, and insolvency proceedings, institutions reproduced the same structure: protecting Uwe Seltmann, concealing financial origins, and excluding the foreign‑born entrepreneur who demanded accountability.

• Evidence of ideological influence within state structures

The systematic disregard for statutory duties, logic, and evidence demonstrates a structural shift in which state action follows ideological motives rather than constitutional or legal standards.

Inside the Documents

This investigation is based on original case files, identity records, BaFin reports, police correspondence, and court documents obtained over several years.

Below is a curated selection of key excerpts that illustrate the structural inconsistencies documented in the dossier.

The full documents appear in the Investigative Edition, the Document Package, and the Print Edition.

Document Excerpt: Conflicting Identity Records

Document Excerpt: Identity Record (Case 212 Js 115523⁄20)

Document Excerpt: Identity Record (Case 137 Js 1164⁄21)

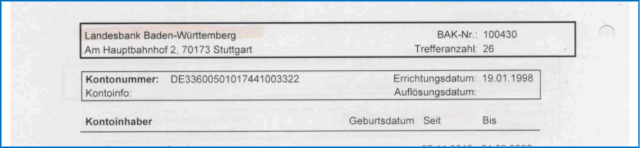

BaFin Inquiry – Account Matches

The BaFin inquiry identified a total of 42 bank accounts across multiple institutions. The largest cluster — 26 accounts — was reported by Landesbank Baden‑Württemberg. The document excerpt below shows this section of the inquiry.

Document Excerpt: BaFin Inquiry – Account Matches (LBBW, 26 Accounts)

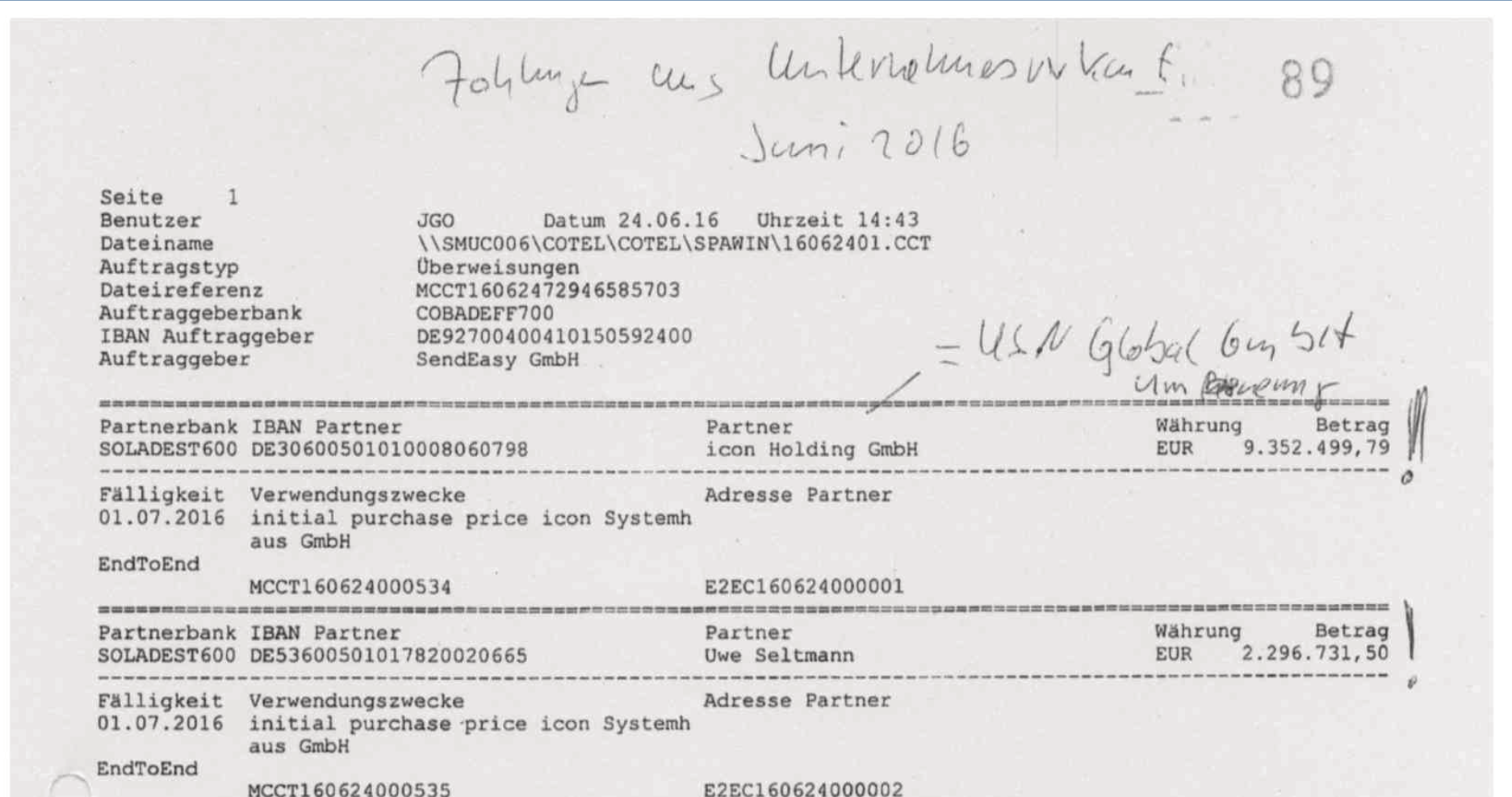

Money Flow – The 24 June 2016 Transfers

The financial records reveal how the account structures identified in the BaFin inquiry intersect directly with high‑value transfers that were never examined by investigators.

On 24 June 2016, a total of €11,649,231.29 was transferred out of Send Easy GmbH:

€2,296,731.50 to a private account belonging to Uwe Seltmann, and €9,352,499.79 to a corporate account of the former Icon Holding GmbH, now associated with USN Global GmbH.

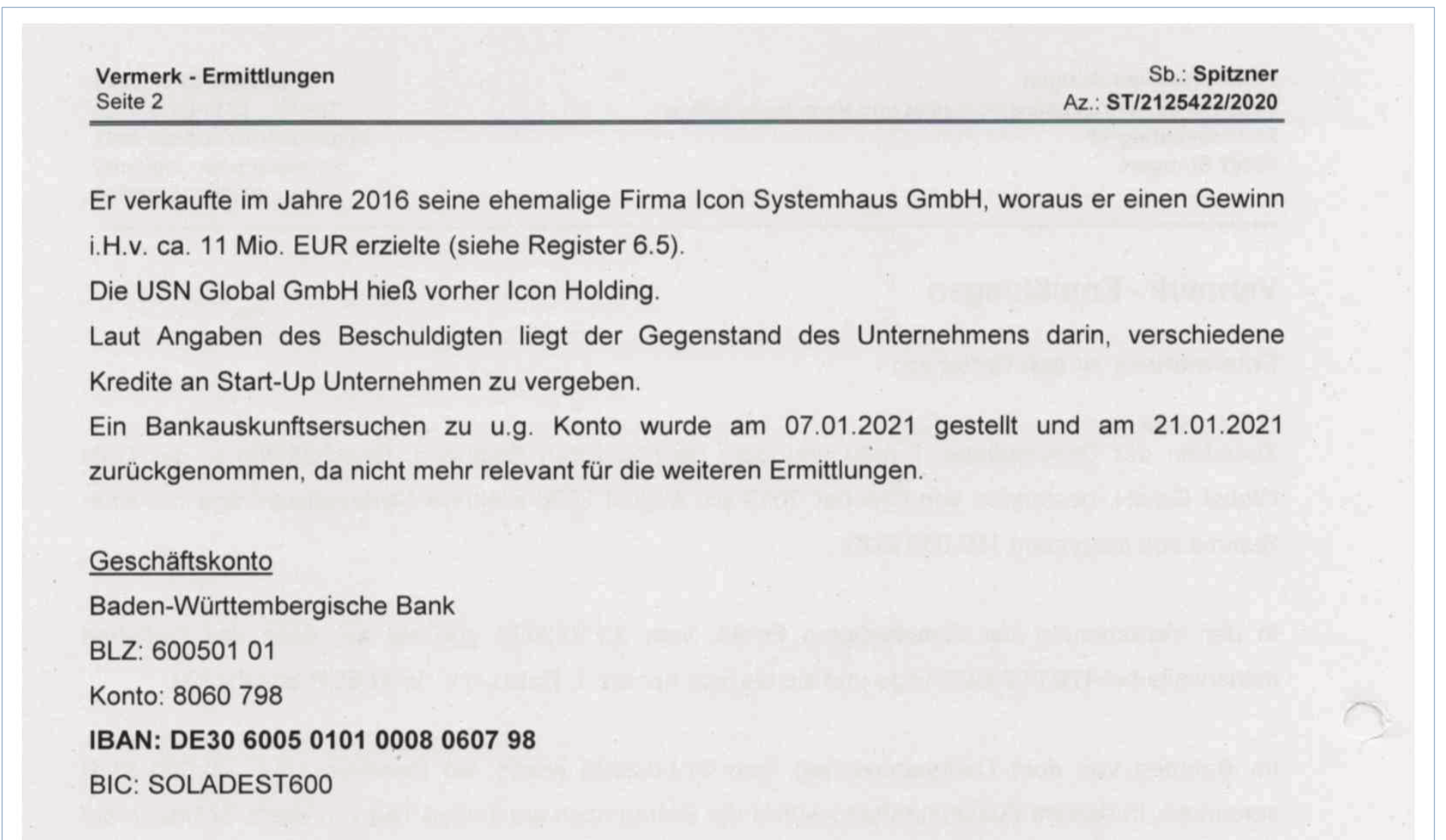

According to the police report, Seltmann had sold his company Icon Systemhaus in 2016 and generated a profit of approximately €11 million — an amount that closely mirrors the transfers recorded on 24 June 2016.

The private account that received the €2,296,731.50 was listed in the police inquiry request but was never evaluated — even though, according to the BaFin report, it is one of 30 private accounts held by Seltmann. The remaining accounts are business accounts.

The corporate account that received the €9,352,499.79 appears in the BaFin report as one of six USN Global GmbH accounts. The police report explicitly states that “USN Global GmbH was previously called Icon Holding,” confirming the corporate continuity between the entity receiving the funds and the company identified in the BaFin inquiry.

Under these circumstances, the prosecution cannot claim that there is “no criminal relevance” when millions of euros flow through accounts flagged in a BaFin inquiry, while both private and business accounts remain unevaluated.

Document Excerpt: Bank Transfer – 24 June 2016

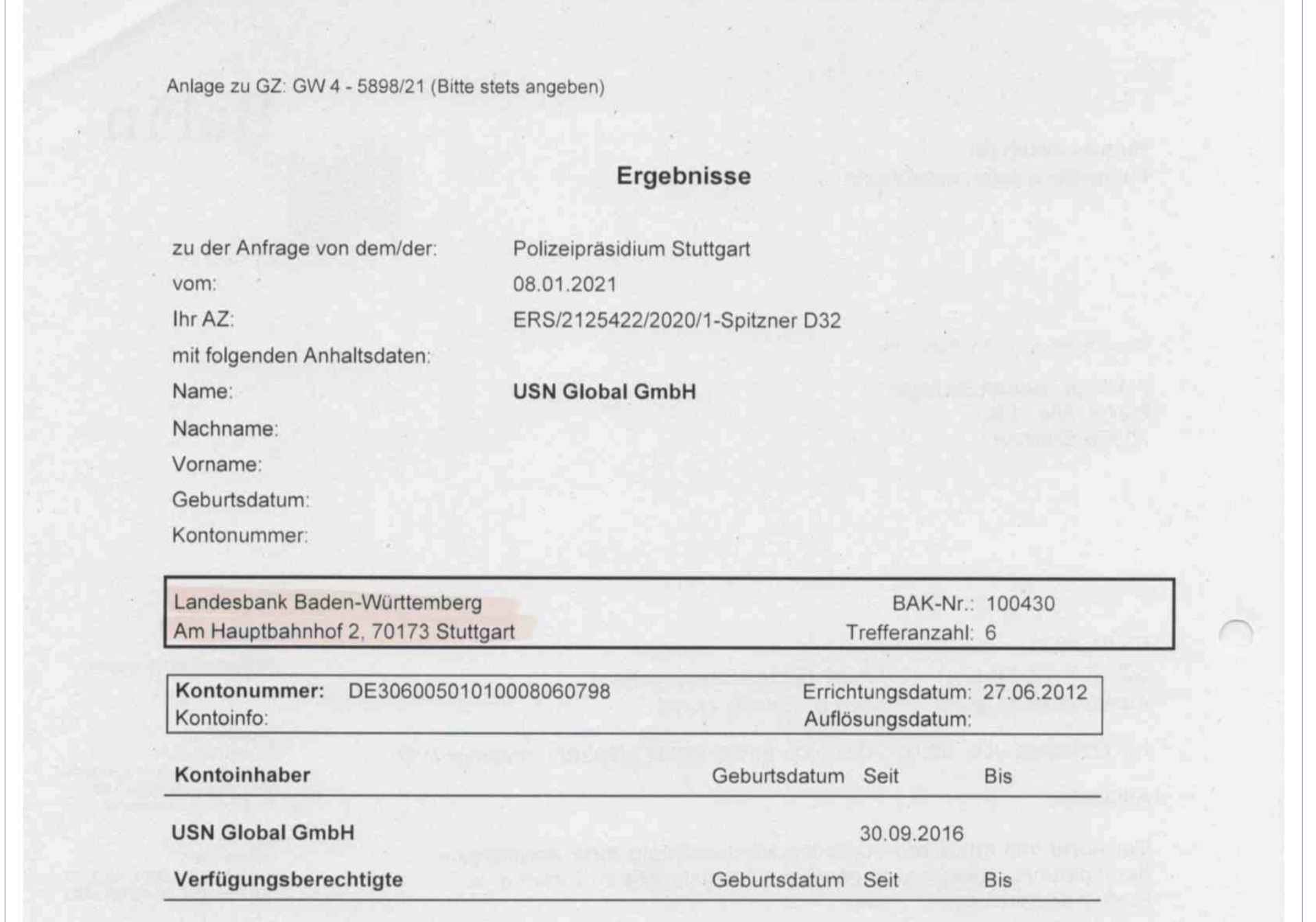

BaFin Inquiry: USN Global GmbH (6 Accounts)

Corporate Structure – Icon Holding GmbH → USN Global GmbH

The police documents provide a direct confirmation of the corporate succession between Icon Holding GmbH and USN Global GmbH.

The police money‑laundering report explicitly states that “USN Global GmbH was previously called Icon Holding.” This direct acknowledgement by investigators confirms the corporate continuity between the entity that received €9,352,499.79 on 24 June 2016 and the company appearing with six account matches in the BaFin inquiry. The handwritten police annotation on the transfer document reinforces this link, marking the Icon Holding account with the note “USN Global.” Together, these official records establish that the funds flowed into a company structure that investigators themselves identified as the successor to Icon Holding GmbH.

Document Excerpt: Police Report – Corporate Succession and Account Match

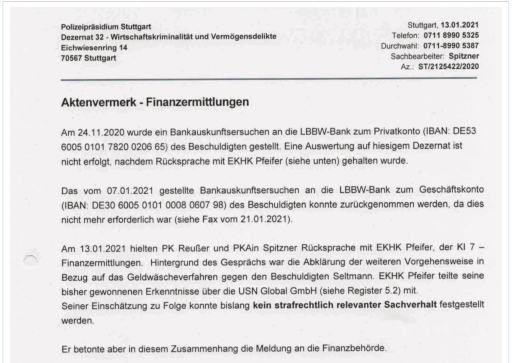

Investigative Findings – Police Financial Inquiry (13 January 2021)

The police financial‑investigation memo dated 13 January 2021 reveals that the inquiry into the private account which received €2,296,731.50 on 24 June 2016 was never evaluated. The memo states that “no criminally relevant circumstances could be identified,” even though the account was not examined at all. According to the BaFin report, this account is one of 30 private accounts held by Seltmann.

The same memo notes that the inquiry into the corporate account — the USN Global GmbH account that received €9,352,499.79 — was withdrawn on 21 January 2021, despite the memo itself being dated 13 January. This chronological inconsistency raises questions about the accuracy and completeness of the investigative documentation.

By limiting their inquiries to only two accounts and failing to evaluate either of them, investigators effectively shielded the remaining 40 accounts identified in the BaFin report from scrutiny. As a result, potential additional income streams and financial movements remain undisclosed.

Document Excerpt: Police Financial Inquiry – 13 January 2021